Insuring Climate Risks w/ AI, IoT, Satellites & Big Data

Insurers are being overtaken by the pace of change. Our climate crisis (among several other factors including technology) is redefining the nature of risk. The industry needs to move quickly to keep up with consumer expectations, close protection gaps, and respond to emerging threats.

Now is a moment of truth for insurers to consider their role in building community and planetary resilience. They must show anxious customers and investors they are taking a proactive role in combatting the causes and effects of our climate crisis and safeguarding communities.

The potential of data to predict risk and anticipate behaviors is driving new kinds of insurance products that are responsive, personal and agile. The rise of usage-based insurance, micro-insurance, and custom policies is redefining protection.

There’s a flipside to concerns about the risks and returns of committing trillions of dollars over decades to mitigate the worst impacts of our climate crisis… the risks of doing nothing, or too little, or acting too slowly. The new ROI is the “risk of inaction.”

Those risks can be found at nearly every level: company, community, national and global. The costs can be measured in catastrophic damage from extreme weather, the disruption of global supply chains, and the displacement of workforces. They can be measured in lives and livelihoods as well as in monetary terms.

The growing impacts of storms, floods, droughts and wildfires are taking their toll on insurers as the resulting payouts are becoming problematic. There will be steep increases in premiums; and for some, it may mean insurance is simply unavailable. Swiss Re estimates a $1.2 trillion “protection gap” of uninsured catastrophic losses.1

AI

With AI, insurance companies have an opportunity to play an increasingly proactive role in helping communities better prepare for our climate crisis. AI has the power to significantly reduce headaches for customers who are victims of climate-related disasters by tracking and warning customers before an incident occurs. AI systems that use historical data to predict climate change will be inaccurate (garbage in / garbage out) because our climate crisis is unprecedented. Our future climate cannot be extrapolated from our historical climate. And the impacts, risks and opportunities of our climate crisis are rapidly evolving… often in unexpected ways. Insurers, governments, and businesses must forge strong partnerships and share data and AI resources to ensure that their predictions are as accurate as possible and that they share their learnings across society.

Given the global scale of the challenge (climate touches everything), cross-sector collaboration is required. The insurance firm Aon, for example, recently brought together leaders from the private and public sectors to discuss how they could collectively work together to close the protection gap using AI and other tools.

The insurance industry will join a wider connected ecosystem – comprising not only partnerships between those in the industry, but also governments and non-governmental organizations – and work with them to tackle the largest challenge humanity as a whole has ever faced. Initiatives including open-source modeling platforms and collaborative ecosystem infrastructures to build a system of risk management that will enable humanity to make better adaptation and mitigation plans and build resilient infrastructures – all fueled by intelligent data.

Powered by data and AI, insurance will take a more dynamic and proactive role in protecting the things we care about. Insurers will shift from premium collectors to property protectors. Being there before things happen. Responding immediately when disaster strikes. Building trust by designing services with genuine added value… services that help people reduce risk and safeguard themselves, their property and their communities.

Insurance coverage (and pricing) was traditionally based on our historical behaviors. By 2030, insurance policies will be written and adjusted in real time based on real time data and activities – so rather than looking back to assess and underwrite insurance risk, we increasingly will look forward based on information gathered in real time.

P&C, Life and all other aspects of insurance have been dramatically impacted by the arrival of continuous real time risk monitoring technology. The very concept of risk has changed – we’ve learned that the faster arrival of the future means the earlier emergence of new risk issues, which requires different forms of risk assessment. This has led to shorter “instance oriented policies” – or what we might call “just in time insurance.”

AI based risk assessment has also taken on a role, with the emergence of real time risk assessment dashboards.2

Internet of Things (IoT) Risk Assessments

With edge computing, 5G connectivity, and the ability to process more and more data in real time, the insurance industry is reaching a point when it can adjust rates by the minute. For example, what was once simply a perk of having a tracker in your car measuring your driving habits (and ultimately helping you lower your premiums by making you a safer driver) is now finding its way into homes, places of business and more.

The proactive way insurance companies are using IoT applications in homes and commercial spaces includes predicting when an issue is more likely to take place (e.g. mini weather stations in forests that constantly measure humidity, temperature and wind speed). The expertise of automatically analyzing that data and notifying the insured might be handled by the insurer or a third party InsurTech vendor. Think about a large electric utility purchasing a policy that includes this fire prevention coverage. When notified that the conditions are ripe for a fire to start in a specific location, the utility can shut down electrical service in that area and avoid sparking a fire and the ensuing liability. PacificCorp was successfully sued by 17 plaintiffs for property damage they suffered during the 2021 Labor Day Fire in Oregon. Jurors found the company owes more than $73 million in total to the plaintiffs for losses related to the fires. This technology will alert utilities about the elevated risk and enable them to avoid starting a fire.

Advanced analytics could help companies in assessing insured property data, and assumptions regarding future climate conditions to improve risk selection and pricing. Augmenting climate-change models with big data/social media information and predictive analytics has the potential to significantly broaden risk assessment considerations.

QBE Insurance Group, for example, has partnered with Jupiter, an InsurTech that offers weather analytics, to leverage its data and analytics across business areas such as underwriting, pricing and resilience management.

Educating clients on climate-related risks and encouraging policy holders to take steps to reduce losses are ways to enhance insurer preparedness in the longer term. Insurance carriers can incent policy holders who invest in mitigating climate-related risks and reducing related claims through adaptation measures.

Incentives can include discounts in premiums or financial assistance to policy holders to help pay for mitigation and adaptation efforts. USAA, for instance, offers premium discounts for homeowners in seven US states who take safety steps to protect their houses from wildfires.

Another large national insurer, Travelers, in association with Wildfire Defense Systems, is offering a value-added service to its California home and landlord policies. This service helps policy holders to tape vents (an entry point for embers) and apply fire retardants at their homes to mitigate risks from wildfires. Such policies and/or services not only reduce losses for insurers but also help to build climate resilient communities. Insurers can also leverage and support industrywide efforts to educate policy holders and lawmakers about how to fortify properties against severe weather events. The president and CEO of the Insurance Institute for Business and Home Safety, Roy E. Wright, testified before Congress in May 2019 that while “the forces of Mother Nature will not be constrained, much of the damage caused by severe weather is avoidable.”

To develop public policies that support greater resilience to climate related risks, insurance companies should collaborate with governments, regulators, and other key stakeholders. Insurers could work with administrative agencies to discourage development in high-risk zones. Similarly, buildings and construction materials can be designed to withstand high winds, storm surges and wild fires. Retrofitting homes to make them more resilient to natural catastrophes could be catalyzed via government programs. Rather than making premiums unaffordable, which leads to a rise in the number of uninsureds, insurers could work proactively with administrative agencies to develop preventive and adaptive public policies supporting a climate-resilient future.3

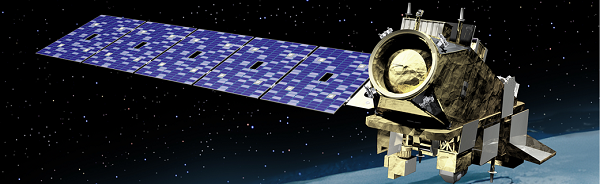

All Seeing Eyes in the Skies

Five years ago, there were approximately fifteen commercially useful earth observation satellites in orbit. Today, thanks to Space-X and other new launching options, over 350 observation satellites encircle the Earth, and the insurance industry is on the cusp of unlocking the potential thanks to branches of AI, including Deep Learning and Computer Vision.

“What was once niche has today become a booming business, with estimates putting the number of small satellites to be launched between 2018 and 2027 in the range of 6,500 to 7,000.” – Geospatial World

The outcome of this space renaissance is unprecedented levels of high-quality, reliable and regularly updated data, on every square meter of Spaceship Earth’s surface.

Insurers don’t need to attempt to build and manage this advanced capability in-house. Many have already partnered with geospatial players, initially on the catastrophe response side.

Machine Learning / Computer Vision + Satellite Images = Property Insights

Geospatial Insight is a UK company pioneering the use of artificial intelligence on satellite imagery to improve decision-making in insurance. Their latest product, PropertyView, delivers new insights and enriched data to help insurers, reinsurers and brokers better understand characteristics associated with specific properties, supporting more confident risk selection and more accurate pricing and coverage.4

With machine learning that is constantly evolving, the company has created feature extractors detecting buildings, cars, driveways, solar panels, roads, containers and more.

It also allows insurers to rapidly populate risk-focused property databases, reducing the burden on clients to provide this information and aiding client on-boarding and retention. Fifty years from the moon landing, insurers are joining the space race.

“Unprecedented” is a word that describes our climate crisis, and it describes the actions we must take. The insurance industry must remake itself to rise to the challenge.

1 https://www.greenbiz.com/article/new-roi-climate-risk-inaction

2 https://www.genpact.com/insight/the-ai-insurance-revolution-in-the-era-of-climate-change

4 https://www.linkedin.com/pulse/underwritten-stars-insurtech-reaches-escape-velocity-rafael-aldon/